不管是純視覺還是多傳感器融合方案,攝像頭幾成智能汽車標配。作為感知層核心傳感器,隨ADAS功能持續升級,車載攝像頭迎來量價齊升機遇。

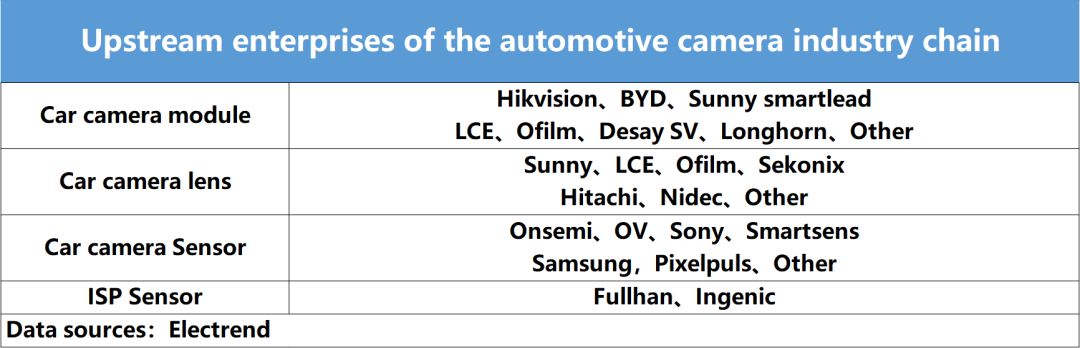

車載攝像頭產業鏈主要涉及上游材料、中游元件和下游產品三個主要環節。

上游包括光學鏡片、濾光片、保護膜、膠合材料、CMOS圖像傳感器、DSP信號處理器、模組封裝等;中游可根據安裝位置的不同分為前視攝像頭、環視攝像頭、后視攝像頭、側視攝像頭、內置攝像頭等;下游作為部件廣泛應用于汽車產業。

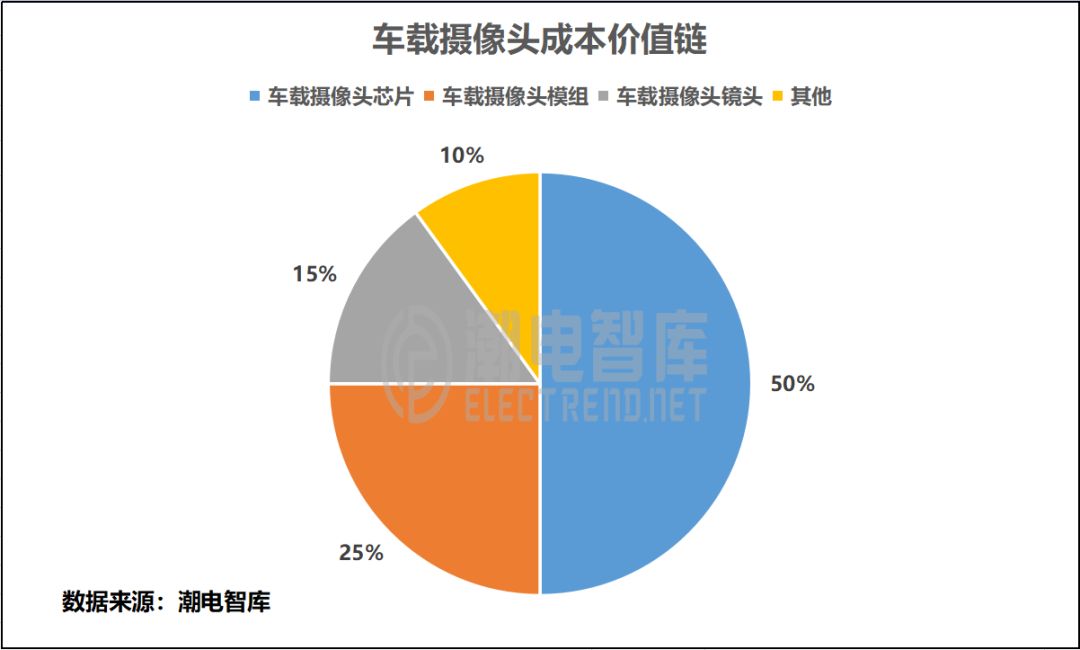

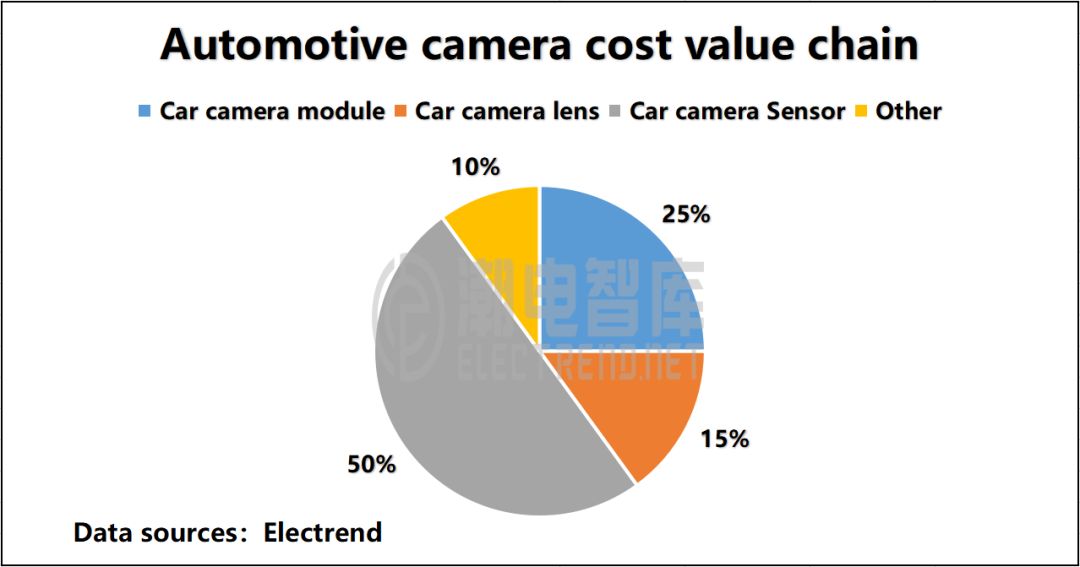

從車載攝像頭成本端分析,CMOS芯片占比最大,超過一半;另外模組封裝占25%,光學鏡頭占15%左右。

根據潮電智庫了解,受互聯網造車思維影響,汽車供應鏈級別概念非常模糊,上游供應商可以向下游整車廠提供完整的攝像頭產品。目前市場份額較大占有者主要為一線汽車Tier1,其客戶群基本覆蓋了全球主要的整車公司。

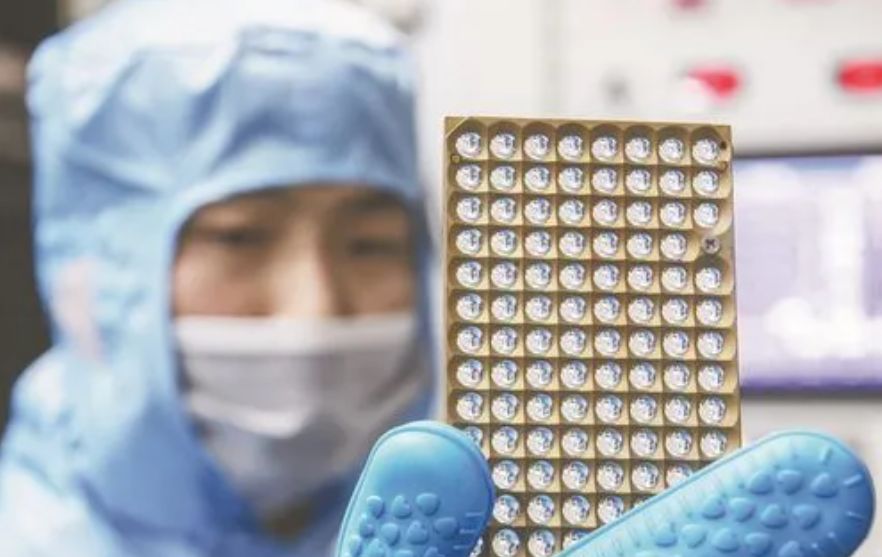

01 CMOS圖像傳感器

相比在手機和安防領域的應用,車載CMOS主要對安全性、可靠性以及圖像質量中的低照度、動態范圍和功能安全方面有更高要求。

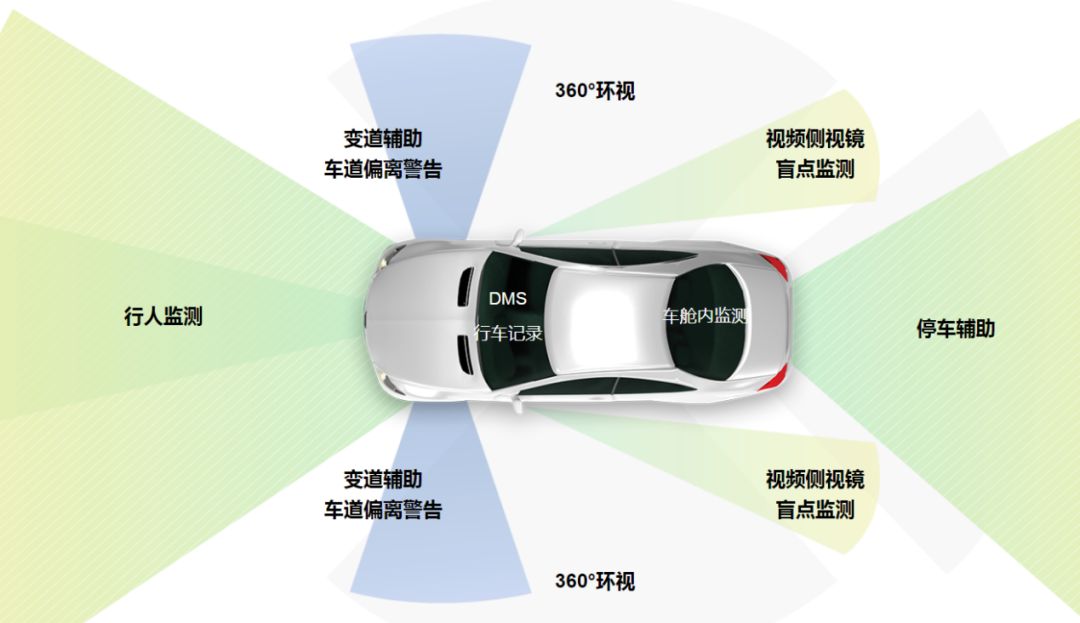

車載CMOS的應用場景主要分為三種,一是360環視、倒車影像、行車記錄儀等;二是ADAS、自動駕駛等;三是DMS等座艙內應用。根據市場趨勢判斷,未來市場增長點主要是來自于ADAS、自動駕駛等領域。

據潮電智庫了解,按照L1-L5不同駕駛等級,每輛汽車對于CMOS圖像傳感器的需求量將超過20顆。

市場數據顯示,2021年全球車載CMOS市場總值為38.1億美元,其中前裝的市場總值為31.4億美元。預計到2026年,全球車載CMOS市場總值將會達到90.7億美元,其中前裝市場總值將達82.8億美元。

目前,車載CMOS主要供應商包括安森美、索尼、豪威集團、思特威、派視爾、格科微、三星等企業。

安森美

收購普拉斯CMOS業務部、圖像傳感器設備制造商Truesense Imaging和Aptina Imaging,讓安森美獲得大量相關專利和技術。其車載CMOS多年穩坐全球第一的位置,主要優勢在于2M及以下市場,這也是目前需求最大的品類。

2022年安森美營收83.3億美元,其中汽車業務收入達33.6億美元,占總收入40%。

思特威

2020年收購Allchip后,思特威于2021年啟動車載CMOS系列產品的研發,應用場景含括360度全景影像、行車記錄儀、駕駛室艙內監控、電子后視鏡、ADAS、電子后視鏡等領域,并同年推出前裝產品SC120AT,實現了整車項目的批量出貨,獲得多個車廠新項目定點。

公司2022年中報顯示,汽車電子收入6599萬元,較上年同期增加15.2%,占主營收入的比例為 6.5%。

02光學鏡頭

光學鏡頭中包括光學鏡片、濾光片等光學器件,對攝像頭的成像質量起到了關鍵作用。光學鏡片一般來說有玻璃和塑膠兩種材質,玻璃鏡片成本較高,但透光率高、熱膨脹系數低;塑膠鏡片則成本較低,但透光率稍低、熱膨脹系數高。

由于車載環境溫度變化大,而溫度會影響鏡片光學性能,因此具備良好熱穩定性的玻璃鏡片更適合車載鏡頭。考慮到成本因素,同時采用兩種材質鏡片的玻塑混合鏡頭可以兼顧成本和性能。一些廠商通過采用特殊的塑膠材料和鍍膜工藝,解決外露面塑料鏡片的可靠性問題,實現可以滿足車載用途的全塑料鏡頭。

目前,車載光學鏡頭的主要供應商有舜宇、聯創電子、歐菲光、宇瞳玖洲光學、弘景光電、大立光等企業,其中以前兩者為代表。

舜宇

以超過30%的市占率,多年穩居車載鏡頭行業第一。根據潮電智庫統計,車載鏡頭2022年出貨量約7900萬顆,同比增長16%。

截至去年上半年,舜宇光學新研發完成多款500萬像素玻塑混合艙內監控車載鏡頭,該類鏡頭可實現駕駛員監控和乘客監控二合一,并且獲得了多家車廠的平臺化項目。同時,300萬像素玻塑混合車載鏡頭已實現量產。

舜宇車載鏡頭客戶主要以Tier 1為主,包括博世、麥格納、法雷奧、大陸等,與Mobileye等算法廠商合作密切。

聯創電子

車載光學行業有一句流行語,“銷量看舜宇,技術看聯創”。聯創是是國內領先的車載鏡頭和模組廠商,擁有模造玻璃-鏡頭-模組全產業鏈布局。

聯創電子去年上半年車載鏡頭及模組營收同比增長910%。公司年產2400萬顆智能汽車光學鏡頭及600萬顆影像模組產業化項目正在加速建設,并計劃于2025年底前形成車載鏡頭和影像模組各5000萬顆的生產能力,滿產后預計年銷售收入近100億元。

潮電智庫從汽車產業鏈獲悉,聯創電子的8M車載鏡頭月交付量已經超過10萬套,成為該產品全球最大的光學供應廠商。

03模組封裝

早期車載攝像頭對像素和規格要求較低,Tier 1廠商主要采用較低端的BGA封裝技術。隨著ADAS技術不斷升級,車載攝像頭小型化、高像素的趨勢下,車載攝像頭封裝工藝更為復雜,逐步采用COB封裝技術。

很多Tier1認為軟件利潤率要相比硬件更高,因此不再大規模投入到攝像頭硬件業務。于是光學廠商逐漸承接攝像頭模組封裝業務,服務Tier1甚至直接供應主機廠。

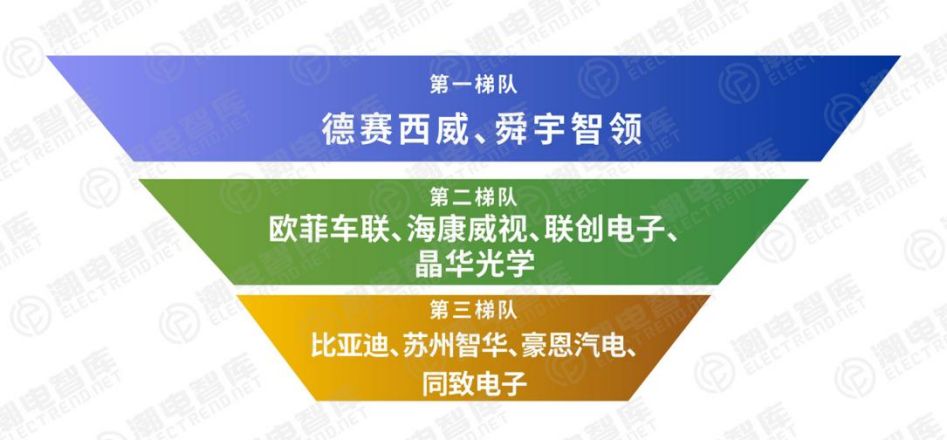

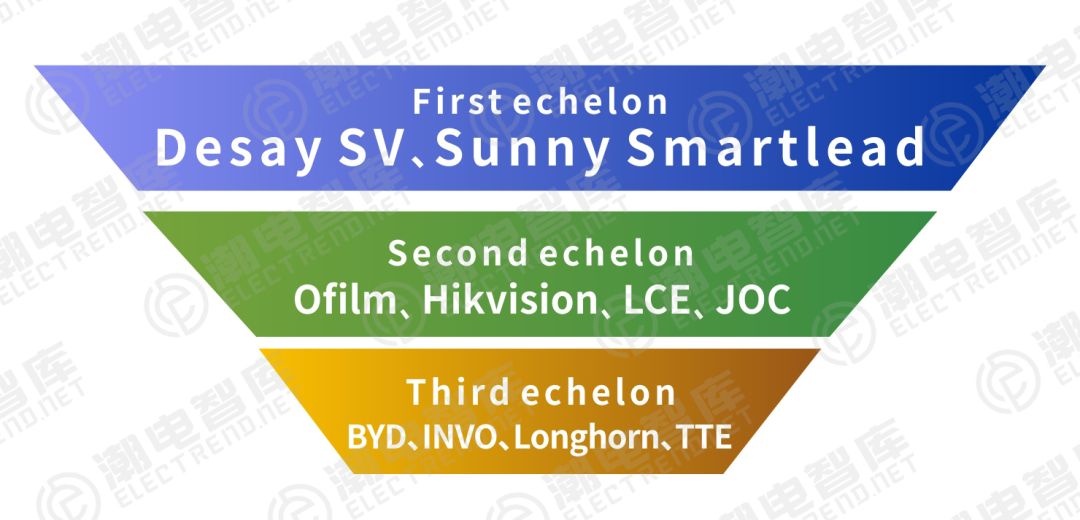

以中國智能汽車發展和供應鏈成長速度,潮電智庫估算,2025年會是國產車載模組對國外反超的時間節點。而且,國產十大車載模組廠商競爭梯隊已經形成。

目前,車載攝像頭模組的主要供應商包括松下、法雷奧、德賽西威、舜宇智領、海康威視、晶華光學、聯創電子、歐菲智能車聯、蘇州智華、豪恩汽電、同致電子等企業。

德賽西威

作為傳統汽車Tier1代表,目前攝像頭只是其汽車電子業務的一個細分產品,但出貨量已經穩居前三。德賽西威的核心競爭力,在于具備國內為數不多可提供域控制器的能力,其豐富的產品矩陣對于整機廠有著更大的吸引力。

目前德賽西威與大眾集團、豐田汽車公司、馬自達集團、沃爾沃汽車、一汽集團、上汽集團、吉利汽車、長城汽車、廣汽集團、奇瑞汽車、蔚來汽車、小鵬汽車、理想汽車等國內外汽車制造商建立了良好的合作關系。

歐菲智能車聯

歐菲光自2015年成立上海歐菲智能車聯科技有限公司,布局智能駕駛、車身電子和智能中控,以光學鏡頭、攝像頭為基礎,延伸到毫米波雷達、激光雷達、抬頭顯示(HUD)、車身域控制器(BCM/BGM)等產品,目前已取得20余家國內車企的一級供應商資質。

據歐菲光披露,公司車載攝像頭產品進展較明顯,其中2M前視三目,8M前視雙目即將量產;3M和8M周視后視攝像頭已量產;1M和2.5M環視攝像頭均已量產;帶加熱功能的2M電子外后視鏡攝像頭已量產;艙內DMS和OMS攝像頭,1M和2M均已量產,5M正在研發。

2023 Automotive Camera Industry Chain /upstream Enterprise Analysis

Whether it's vision or multi-sensor fusion solutions, cameras are almost standard equipment for smart cars. As the core sensor of the perception layer, with the continuous upgrading of ADAS functions, car mounted cameras are facing opportunities for both quantity and price.

The automotive camera industry chain mainly involves three main links: upstream materials, midstream components, and downstream products.

Upstream includes optical lenses, filters, protective films, adhesive materials, CMOS image sensors, DSP signal processors, module packaging, etc; The midstream can be divided into front view cameras, surround view cameras, rear view cameras, side view cameras, built-in cameras, etc. according to the installation location; Downstream is widely used as a component in the automotive industry.

From the cost analysis of car mounted cameras, CMOS chips account for the largest proportion, exceeding half; In addition, module packaging accounts for 25%, and optical lenses account for about 15%.

According to the Electrend, the concept of automotive supply chain level is very vague due to the influence of internet car manufacturing thinking. Upstream suppliers can provide complete camera products to downstream vehicle manufacturers. At present, the main market share holder is the Tier 1, a first tier car, with a customer base that basically covers major global vehicle companies.

1、 CMOS image sensor

Compared to applications in mobile phones and security, in car CMOS mainly has higher requirements for safety, reliability, low illumination, dynamic range, and functional safety in image quality.

The application scenarios of in car CMOS are mainly divided into three types: 360 surround view, reverse camera, driving recorder, etc; The second is ADAS, autonomous driving, etc; The third is the application of DMS and other cockpit applications. According to market trends, future market growth points will mainly come from fields such as ADAS and autonomous driving.

According to the Electrend, the demand for CMOS image sensors per car will exceed 20 according to different driving levels of L1-L5.

According to market data, the global in car CMOS market value in 2021 was 3.81 billion US dollars, of which the market value for front-end devices was 3.14 billion US dollars. It is expected that by 2026, the global in car CMOS market value will reach 9.07 billion US dollars, with the total value of the front-end market reaching 8.28 billion US dollars.

At present, the main suppliers of in car CMOS include companies such as Onsemi, Sony, Omnivision Group, smartsense, Pixelplus, Galaxycore, Samsung, etc.

Onsemi:Acquired the Plass CMOS business unit and image sensor equipment manufacturers Truesense Imaging and Aptina Imaging, allowing Ansemy to obtain a large number of related patents and technologies. Its in car CMOS has remained the world's number one for many years, with its main advantage in the 2M and below market, which is currently the category with the highest demand.

In 2022, Onsemi's revenue was $8.33 billion, of which the automotive business revenue reached $3.36 billion, accounting for 40% of the total revenue.

Smartsense: After acquiring Allchip in 2020, Sitewei launched the research and development of the in car CMOS series products in 2021. The application scenarios include 360 degree panoramic imaging, driving recorder, cockpit monitoring, electronic rearview mirror, ADAS, electronic rearview mirror, and other fields. In the same year, Sitewei launched the front end product SC120AT, achieving mass shipment of the entire vehicle project and obtaining new project targets from multiple car manufacturers.

According to the company's 2022 midterm report, the revenue from automotive electronics was 65.99 million yuan, an increase of 15.2% compared to the same period last year, accounting for 6.5% of the main revenue.

2、 Optical lens

The optical lens includes optical components such as lenses and filters, which play a crucial role in the imaging quality of the camera. Generally speaking, optical lenses are made of glass and plastic. The cost of glass lenses is high, but the transmittance is high and the coefficient of thermal expansion is low; The cost of plastic lens is lower, but the transmittance is slightly lower, and the coefficient of thermal expansion is high.

Due to the large temperature changes in the car environment, which can affect the optical performance of the lens, glass lenses with good thermal stability are more suitable for car lenses. Considering cost factors, using two types of glass plastic hybrid lenses simultaneously can balance cost and performance. Some manufacturers solve the reliability problem of exposed plastic lenses by using special plastic materials and coating processes, achieving all plastic lenses that can meet automotive applications.

At present, the main suppliers of automotive optical lenses include Sunny, LCE, Ofilm, YTOT, Hongjing, Largan and other enterprises, with the former two being representatives.

Sunny:With a market share of over 30%, it has consistently ranked first in the automotive lens industry for many years. According to the statistics of Electrend, the shipment volume of car mounted lenses in 2022 is about 79 million, a year-on-year increase of 16%.

As of the first half of last year, Shunyu Optics has newly developed and completed multiple 5 megapixel glass plastic hybrid cabin monitoring car lenses, which can achieve driver monitoring and passenger monitoring in one, and has obtained platformization projects from multiple car manufacturers. Meanwhile, the 3 megapixel glass plastic hybrid car lens has been mass-produced.

Sunny's car lens customers mainly focus on Tier 1, including Bosch, Magna, Valeo, Continental, etc., and have close cooperation with algorithm manufacturers such as Mobileye.

LCE:There is a popular saying in the automotive optics industry, 'Sales are determined by Sunny, technology is determined by LCE'. LCE is a leading manufacturer of automotive lenses and modules in China, with a complete industrial chain layout of molded glass lenses modules.

LCE' revenue for car mounted lenses and modules increased by 910% year-on-year in the first half of last year. The company's industrialization project of producing 24 million intelligent car optical lenses and 6 million image modules annually is accelerating construction, and plans to form a production capacity of 50 million each for car mounted lenses and image modules by the end of 2025. After full production, the expected annual sales revenue is nearly 10 billion yuan.

Electrend learned from the automotive industry chain that the monthly delivery volume of Lianchuang Electronics' 8M in car lenses has exceeded 100000 sets, making it the world's largest optical supplier of this product.

3、 Module packaging

Early car mounted cameras had lower requirements for pixels and specifications, and Tier 1 manufacturers mainly used lower end BGA packaging technology. With the continuous upgrading of ADAS technology and the trend of miniaturization and high pixel of car mounted cameras, the packaging process of car mounted cameras has become more complex, gradually adopting COB packaging technology.

Many Tier1 believe that software profit margins are higher than hardware, so they no longer invest heavily in camera hardware business. So optical manufacturers gradually took on the packaging business of camera modules, serving Tier1 and even directly supplying the host factory.

based on the development speed of China's intelligent vehicles and supply chain growth, Chaodian Think Tank estimates that 2025 will be a time point for domestic vehicle modules to compete with foreign counterparts. Moreover, a competitive echelon of the top ten domestic car module manufacturers has been formed.

At present, the main suppliers of car mounted camera modules include Panasonic, Valeo, Desay SV, SUNNY, Hikvision, JOC, LCE, OFILM, INVO, Longhorn, Tungthin and other enterprises.

Desay SV:As a representative of the traditional automotive Tier1, the camera is currently only a segmented product in its automotive electronics business, but its shipment volume has stabilized in the top three. The core competitiveness of Desai Xiwei lies in its ability to provide domain controllers, which is one of the few in China. Its rich product matrix has greater appeal to the entire machine factory.

At present, Desay SV has established good cooperation relations with domestic and foreign automobile manufacturers such as Volkswagen Group, Toyota Motor Corporation, Mazda Group, Volvo Cars, FAW Group, SAIC Motor Corporation, Geely Automobile, Great Wall Motor, GAC Group, Chery Automobile, Weilai Automobile, Xiaopeng Automobile, Ideal Automobile, etc.

Ofilm: Since 2015, Ofilm has established Shanghai Oufei Intelligent Vehicle Connected Technology Co., Ltd., specializing in intelligent driving, body electronics, and intelligent central control. based on optical lenses and cameras, Ofilm has extended to products such as millimeter wave radar, LiDAR, head up display (HUD), and body domain controller (BCM/BGM). Currently, it has obtained first-class supplier qualifications from more than 20 domestic car companies.

According to Ofilm, the company's in car camera products have made significant progress, with 2M front facing three cameras and 8M front facing two cameras about to be mass-produced; 3M and 8M perimeter and rear view cameras have been mass-produced; Both 1M and 2.5M ambient cameras have been mass-produced; The 2M electronic exterior rearview mirror camera with heating function has been mass-produced; The DMS and OMS cameras in the cabin, both 1M and 2M, have been mass-produced, and 5M is currently under development.