智能手機、TWS勢微的大環境下,智能手表逆勢增長。

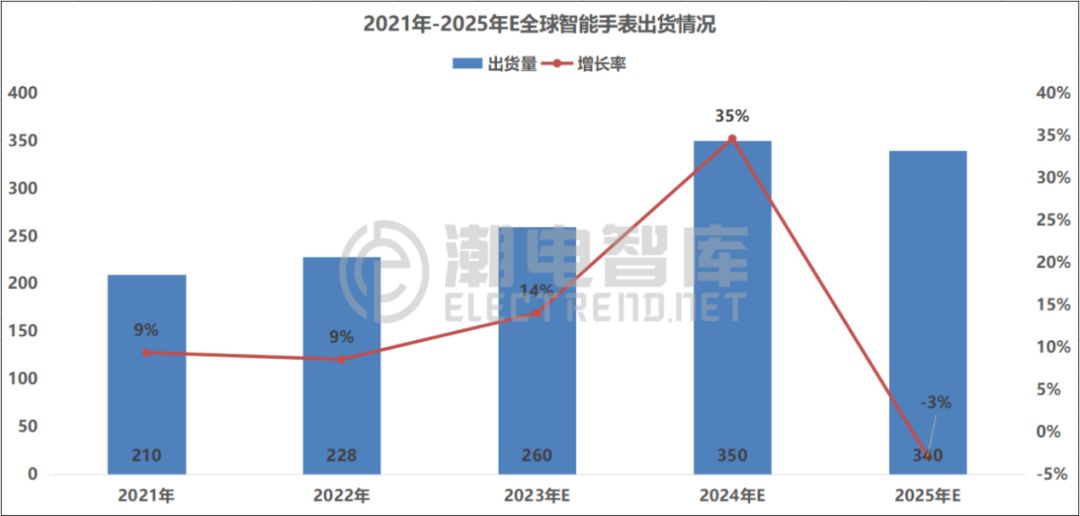

潮電智庫統計數據顯示,2022年全球智能手表出貨量2.28億只,同比增長9%;預計2023年增速為14%。

>

目前來看,智能手表領域還未形成標準化,產品在功能應用端存有充足的創新空間,至少未來兩年將會延續向上增長態勢。

根據潮電智庫統計,2022年十大全球智能手表廠商共占全球市場份額達72%。其中,蘋果和華為分別以21%和10%的市占率名列一、二。

以出貨量、市場份額、產品結構、在售款數等企業經營關鍵指標形成綜合競爭力,潮電智庫認為,2023年全球智能手表廠商的競爭梯隊已成型。

其中,蘋果、華為、三星位列第一梯隊;佳明、Noise、Fire-Boltt、boAt為第二梯隊;小天才、華米、小米則為第三梯隊。

下面將從出貨量、產品結構、在售款數等三大關鍵要素展開綜述。

01出貨量

持續上漲的出貨量彰顯著旺盛的市場需求,產品擴容迭代的空間進一步擴大。

第一梯隊的競爭亦十分激烈。相較于上一年,蘋果的出貨量在上升,但市占率在下降,這意味著市場擴大的情況下,來搶奪蛋糕的高手玩家也增多了。需要指出的是,第一梯隊的三位玩家皆為生態大廠,且都有智能手機產品加持,也就是通稱的“手機系”。

從去年開始,受惠人口紅利,印度躍升至全球最大智能手表市場。Noise、Fire-Boltt、boAt等本土品牌強勢崛起,成為第二梯隊的代表。

出貨量排名位列六、七位的皆著眼于細分賽道,分別是專注于運動板塊的佳明和兒童版塊的小天才。

02產品結構

從榜單來看,2023年全球智能手表市場有四大“高端玩家”,分別是蘋果、華為、三星、佳明,中高端市場有小天才和華米兩位玩家,Noise、Fire-Boltt、boAt、小米在中低端市場受到歡迎。

其中,蘋果與華為的高端榜首之爭越演越烈。

今年2月有消息傳出,蘋果智能手表在實現無創血糖監測功能方面取得重大突破,并且已經進入概念驗證階段。據產業鏈專家分析,這一功能主要是針對中國市場需求專門設計。不過同時有報道稱,蘋果可能還需要額外3-7年時間才能實現將此項技術的硬件縮小到適合Apple Watch大小。

華為自然也不甘示弱。今年3月,華為發布了全新高端旗艦華為WATCH Ultimate,這是全球首款支持雙向北斗衛星的大眾智能手表。對此,英國知名科技媒體Trusted Reviews評價,“華為WATCH Ultimate將成為Apple WATCH Ultra的克星。”

Noise、Fire-Boltt、boAt雖然合計占據印度七成以上的市場份額,但其對本地消費過高的依賴性,以及中低端產品的市場站位決定它們難以走出印度,因此在市場份額的增長上具有一定局限性。

與此同時,從芯片、顯示屏、電池等核心器件供應,以及ODM制造各個環節,印度品牌基本倚仗中國。從這一層面上來看,印度市場更像是中國供應鏈的“試金石”與掘金地。

03在售款數

從榜單分析,市占率跑速較快的中低端玩家的玩法是多款、低價、跑量。

例如Noise、Fire-Boltt、boAt的在售款數分別是49、68、66,這相當于前三名高端玩家在售款數的8-22倍。

雖然蘋果、三星、華為的在售款數不多,但依然賺得盆滿缽滿,成為各自營收的重要來源。由此可見,高端產品具備更為強大的吸金能力,也是衡量品牌綜合競爭力的重要指標。

值得注意的是,此前手環領域的王者小米卻異常低調,在智能手表中低端賽道上表現出觀望的特點,其在售款數只有4款,市場份額僅為4%。那么,一向以產品款式豐富為特質的小米為什么在中低端賽道上沒有重兵投入,是否有走向高端市場的想法?尚待觀察。

Top 10 smart watch brands: Apple and Huawei evenly to be NO.1, while XIAOMI is the most mysterious

The smartphones and TWS markets are declinling, while smart watches markets are growing.

According to statistics from Electrend, the global shipment volume of smart watches in 2022 was 228 million, a year-on-year increase of 9%; The expected growth rate in 2023 is 14%.

At present, the field of smart watches has not yet formed standardization, and there is sufficient innovation space for products in functional applications. At least in the next two years, it will continue to grow upwards.

According to statistics from Electrend, the top ten global smartwatch manufacturers accounted for a total of 72% of the global market share in 2022. Among them, Apple and Huawei ranked first and second with a market share of 21% and 10%, respectively.

based on key business indicators such as shipment volume, market share, product structure, and number of models on sale, Electrend believes that the competitive ladder of global smartwatch manufacturers has formed in 2023.

Among them, Apple, Huawei, and Samsung rank in the first tier; Garmin, Noise, Fire Boltt, and boAt are the second tier teams; Okii, Huami, and Xiaomi are the third tier teams.

The following will provide an overview of three key factors: shipment , product structure, and number of products on sale.

1、shipment

The continuously rising shipment volume highlights strong market demand, and the space for product expansion and iteration is further expanded.

The competition in the first tier is also very fierce. Compared to the previous year, Apple's shipment volume is increasing, but its market share is decreasing, which means that as the market expands, there are also more skilled players coming to grab the cake. It should be pointed out that the three players in the first tier are all ecological giants and are all supported by smartphone products, commonly known as the "mobile phone series".

Since last year, thanks to the demographic dividend, India has jumped to the world's largest smart watch market. Local brands such as Noise, Fire-Boltt, and boAt have risen strongly and become representatives of the second tier.

Ranked sixth and seventh in terms of shipment volume, both focus on segmented tracks, namely Jiaming, who focuses on the sports sector, and Little Genius, who focuses on the children's sector.

2、Product Structure

From the list, there are four "high-end players" in the global smartwatch market in 2023, namely Apple, Huawei, Samsung, and Jiaming. In the mid to high end market, there are two players: Xiaotian and Huami. Noise, Fire Boltt, boAt, and Xiaomi are popular in the mid to low end market.

Among them, the competition for high-end top spot between Apple and Huawei is becoming increasingly fierce.

In February this year, it was reported that Apple's smart watch had made a major breakthrough in realizing the non-invasive blood glucose monitoring function, and had entered the proof of concept stage. According to the analysis of industry chain experts, this function is mainly designed specifically for the needs of the Chinese market. However, there are also reports that Apple may need an additional 3-7 years to achieve the hardware reduction of this technology to fit the Apple Watch size.

Huawei is naturally not willing to be outdone. In March of this year, Huawei released its new high-end flagship Huawei WATCH Ultimate, which is the world's first Volkswagen smartwatch that supports bidirectional Beidou satellites. Regarding this, the well-known British technology media Trusted Reviews commented, "Huawei WATCH Ultimate will become the nemesis of Apple WATCH Ultra.

Although Noise, Fire Boltt, and BoAt collectively occupy over 70% of the market share in India, their high dependence on local consumption and the market position of mid to low-end products make it difficult for them to exit India, so they have certain limitations in increasing market share.

At the same time, Indian brands rely heavily on China for the supply of core components such as chips, displays, batteries, and various aspects of ODM manufacturing. From this perspective, the Indian market is more like a touchstone and gold digger for China's supply chain.

portant;">

portant;">3、Number of models for sale

From the analysis of the list, the gameplay of mid to low-end players with fast market share is multiple options, low prices, and running volume.

For example, the number of models on sale for Noise, Fire Boltt, and BoAt is 49, 68, and 66, respectively, which is equivalent to 8-22 times the number of models sold by the top three high-end players.

Although Apple, Samsung, and Huawei have a small number of models on sale, they still make a lot of money and become important sources of revenue for each company. From this, it can be seen that high-end products have a stronger ability to attract money and are also an important indicator to measure the comprehensive competitiveness of a brand.

It is worth noting that Xiaomi, the previous king in the field of bracelets, has been exceptionally low-key and has shown a wait-and-see characteristic on the low-end track of smart watches. It has only four models on sale and a market share of only 4%. So, why hasn't Xiaomi, which has always been characterized by rich product styles, invested heavily in the mid to low end track? Do they have the idea of moving towards the high-end market? It remains to be observed.